How to pay tax in Spain and what is the tax free allowance?

Taxes in Spain are split between regional and national tax and resident and non-resident tax. Find out how much tax you need to pay and how to pay it.

Shreya

Paying tax in Spain isn't so straightforward. How much tax you pay or what you pay taxes on is determined by your geographical, professional, personal, and economic circumstances.

To help you navigate this confusing system, we’re answering all questions that’ll explain what taxes you need to pay, when, how, and few ways to reduce taxes.

Do expats pay taxes in Spain?

Expats who earn an income or own assets in Spain need to pay taxes. Depending on your place of residence, you can be considered a resident or non-resident taxpayer in Spain.

Resident taxpayer

A Spanish tax resident is someone who:

- Lives more than 183 days of a calendar year in Spain

- Earns an annual income of more than €22,000

- Is self-employed and has a business in Spain

- Has legal family members in Spain

- Has rented out property in Spain and earns at least €1,000

- Has savings or profits worth more than €1,600 in a Spanish bank account

As a Spanish tax resident, you’ve to pay progressive taxes on your worldwide income. So aside from income generated in Spain, you need to declare your assets abroad if they’re worth more than €50,000 or if any individual asset’s worth increases by more than €20,000.

Non-resident taxpayer

A non-resident taxpayer in Spain is someone who:

- Lives less than 183 days in Spain

- Earns some income in Spain

A non-resident only has to pay taxes on income generated in Spain.

Exceptions for paying tax in Spain

There’re certain instances when you’re exempt from declaring your taxes in Spain. Some of them include:

- If you only have one job and earn less than €22,000 a year

- If you’ve multiple jobs and earn less than €14,000 a year

- If your capital gains total to less than €1,600 a year

- Annuities for child support

What taxes do you pay in Spain?

There’re are mainly 6 types of taxes for expats in Spain:

1. Income Tax (IRPF) or Non-resident income tax (NRIT)

Residents pay personal income tax, also known as Impuesto de Renta sobre las Personas Fisicas or IRPF. Non-residents pay the non-resident income tax (NRIT). Additionally, Income tax's calculated based on 2 types of incomes:

- General taxable income: This includes all the income that you gain from employment or things like the lottery.

- Savings taxable income: This includes indirect income, such as shares or dividends in companies, interest, pension, capital gains, or insurance income.

2. Inheritance and gift tax

Any lifetime gift or asset passed on to you by family or friends will be progressively taxed under inheritance (succession) or gift tax. Each autonomous region has different inheritance laws and tax rates. Each region also decides it’s own tax relief rates, depending on your relationship with the donor.

3. Wealth tax

You need to pay wealth tax only if your highly valued assets – such as cars, properties, art, jewellery, etc.– are worth more than the personal allowance of €700,000. Some exceptions include:

- If you’re a resident and own property in Spain, you’re given an additional allowance of €300,000.

- Some regions have a lower personal allowance. For example, if you’re in Catalonia, the personal allowance is €500,000.

Residents need to pay this tax on their worldwide assets. Non-residents need to pay it on their assets in Spain.

4. Capital gains tax

Capital gains tax refers to the tax you pay on any amount earned by transferring an asset, such as selling your house or shares. The money you earn's viewed as savings income and is taxed differently to earned income.

5. VAT (IVA)

VAT or value added tax is known as Impuesto sobre el Valor Añadido (IVA) in Spain. IVA's a sort of consumption tax and is applied to all goods and services that are considered taxable in Spain.

6. Property tax

Property owners in Spain need to pay:

- The annual property tax, also known as Impuesto Sobre Bienes Inmuebels (IBS).

- Income tax based on the rent earned

- Capital gains tax on the profit from selling the property (if applicable)

- Wealth tax if total wealth is valued at greater than €700,000.

Income tax for property's different for resident and non-resident taxpayers. Unlike residents who need to pay progressive taxes, non-resident taxpayers have a fixed tax rate. They also pay different taxes depending on if their property is rented out or not rented out.

How much tax do you pay in Spain?

Non-residents pay a flat tax rate of 24% (non-EU citizens) or 19% (EU or EEA citizens) on their income generated in Spain.

Residents pay taxes which are progressive in nature. The tax rates differ across the 17 autonomous regions as each region sets its own tax rates on top of the state level taxes.

Spanish tax rates for expats

Since tax rates differ across each autonomous region, we’re sharing the state level tax rates. Please have a look at the website of the autonomous region to know the regional tax rates.

Spain’s income tax rate for 2023 is:

| Income tax bracket | Tax Rate | |

|---|---|---|

| Up to €12,450 | 19% | |

| €12,450 - €20,000 | 24% | |

| €20,000 - €35,200 | 30% | |

| €35,200 - €60,000 | 37% | |

| €60,000 - €300,000 | 45% | |

| More than €300,000 | 47% | |

| Non-Resident (non-EU) | 24% | |

| Non-Resident (EU or EEA) | 19% |

Spain’s savings tax and capital gains tax bracket:

The taxation rate for savings income and capital gains tax is the same.

| Savings and Capital Gains tax bracket | Tax Rate | |

|---|---|---|

| Up to €6,000 | 19% | |

| €6,000 - €50,000 | 21% | |

| €50,000 - €200,000 | 23% | |

| More than 200,000 | 26% | |

| Non-Resident | 19% |

Spain’s inheritance tax rate in 2023:

Inheritance tax's charged between 7.65% to 34%. The exact amount's highly individual as various factors determine the tax you pay, such as your age, location, relationship to the the inheritance provider, and more.

Luckily, most autonomous regions offer discounts to those inheriting. 1. Children under 21 get an allowance of €47,859. 2. Children above 21, spouse, grandchildren, parents or grandparents receive an allowance of €15,957 3. Siblings, nephews and nieces, aunts and uncles, in-laws, and their ascendants or descendants get an allowance of €7,993. 4. Any friends, cousins, or other unrelated relatives get no allowances.

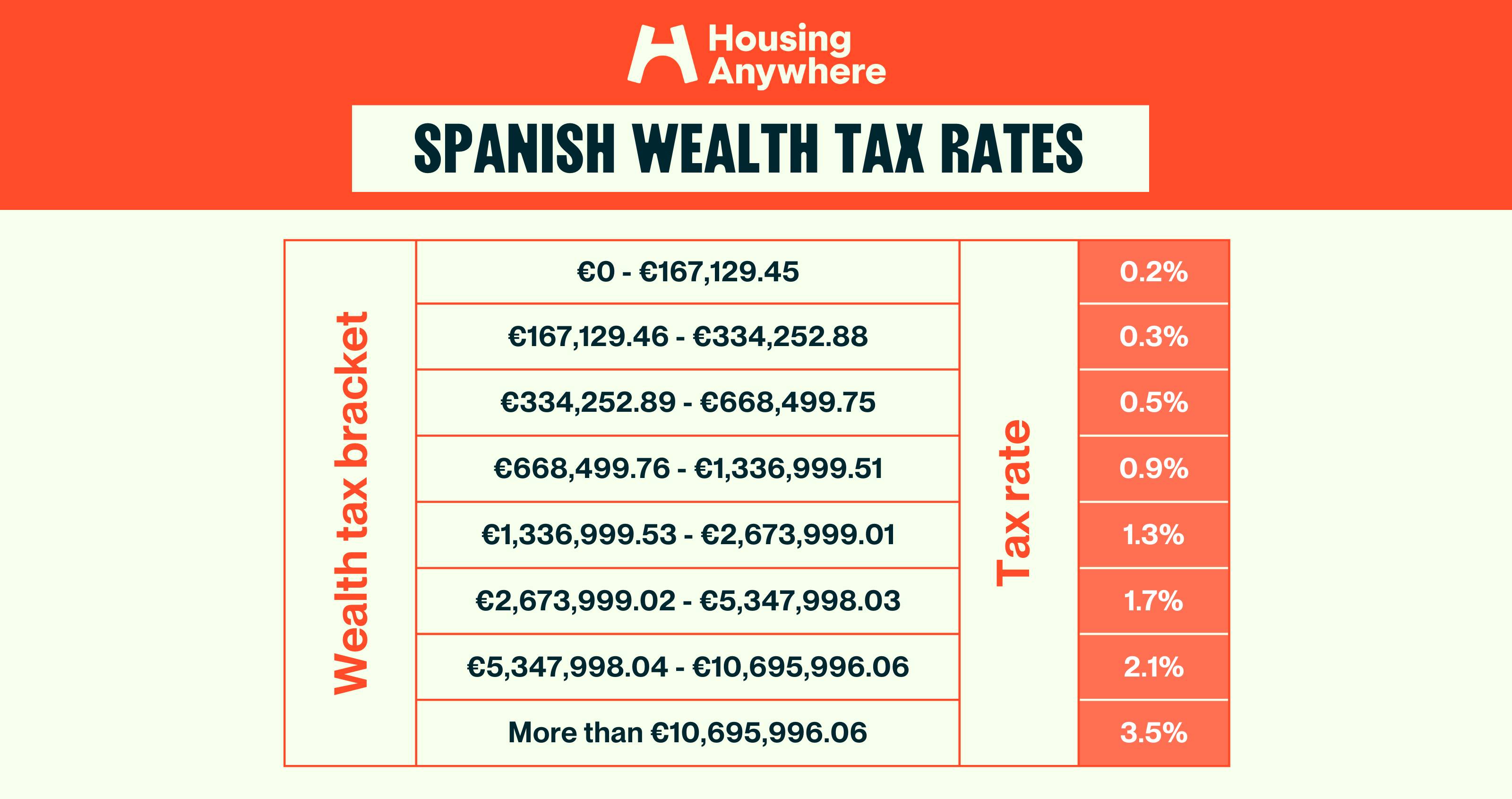

Spain’s wealth tax rate in 2023:

In general, the wealth tax in Spain is progressive and between 0.2% to 2.5%. So for any amount above €700,000, you’ll need to pay:

Some regions have different wealth tax rates. For example

- Madrid- 0%

- Valencia- 0.25% - 3.5%

- Catalonia- 0.21% - 2.75%

- Andalucia- 0.2% - 2.5%

Spain’s VAT rate in 2023 is:

- 21% for general goods & services

- 10% reduced rate for transport, non-basic food, toll roads, government services.

- 4% reduced rate for essentials

Spain’s property tax rate for 2023:

The property tax rate in Spain's between 0.4% to 1.1% of the cadastral value of the property. The exact percentage depends on the autonomous region. You can find the most up to date cadastral value on the annual property tax invoice.

Besides, you also need to pay income tax. If you’re a resident, income tax's paid on your total income, which includes the rent and other income sources.

If you’re a non-resident taxpayer, income tax is determined by the rental or occupancy status.

| Rental condition | Non-resident Property tax (EU/EEA) | Non-resident Property Tax (Non-EU) |

|---|---|---|

| Rented out | 19% | 24% |

| Not rented out | 19% on 1.1% or 2% of the cadastral value of the property | 24% on 1.1% or 2%* of the cadastral value of the property |

(* You pay 1.1% of the cadastral value if the property’s cadastral value has been updated since 1994. If not, you’ll pay 2%.)

When should I pay taxes in Spain?

The tax year in Spain's from 1st January until 31st December. You need to file your tax return within April 6 to June 30 of next year.

How to pay taxes in Spain?

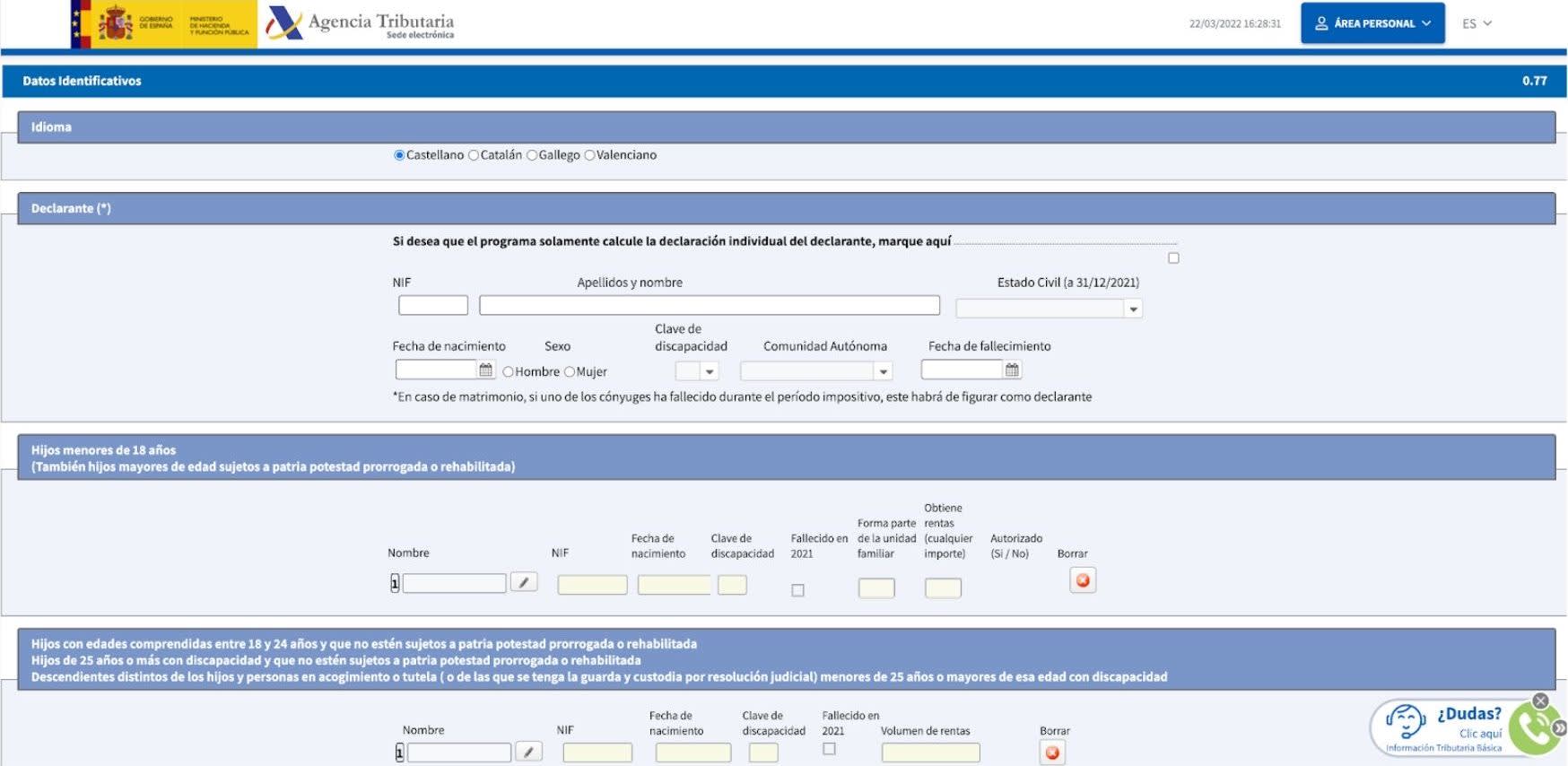

To file your tax return, you need to register with Spain’s tax agency- Agencia Tributaria (Hacienda). Once you’ve done that, you can file your taxes as both resident and non-resident.

Pay tax as a resident

Paying taxes in Spain can be done via the tax agency’s website, mobile app, telephone, or in person. Since most people do it online, here’s how you can file your electronic tax return:

- Select the relevant form (modelo) to file your tax return. To file your income tax return, you need Modelo 100.

- Click on Renta Web to file your electronic tax return. This's a secure system introduced by Agencia Tributaria to file a draft tax return, submit tax returns, make modifications, or view the status of your current and previous tax returns. Note-this's only accessible from April to June.

- To access Renta Web, identify yourself with your NIE number, which serves as your Spanish tax ID number. Or use one of the following digital identification methods- CI@ve, TOKEN, Número de referencia, or Certificado y DNI electrónico.

- Simply follow the instructions on screen or use the video instructions (in Spanish) to file your draft tax return. You can save this and submit it when it’s complete.

Expats often hire a gestor (accountant) to help file their tax returns as it can be a complex process, especially as the online system isn't in English.

Pay tax as non-resident

- To file your income tax return as a non-resident in Spain, select Modelo 210. There’re more tax forms to choose from if a different situation applies to you.

- Fill up this form (modelo) on Renta Web and submit when ready.

Most non-residents pay tax on their property in Spain. If this applies to you, remember that you need to file your income tax quarterly if your property is rented out or annually if it isn’t rented out.

What if I paid too much tax?

If you’ve paid too much tax in Spain, you’ll get a tax refund directly in your bank account within 6 months of the tax filing deadline (6 months from 30th June). So make sure you’ve submitted your up to date Spanish bank account details when filing your return.

To find out if you’ll receive a tax refund, log in to Renta Web to check your status.

How can I reduce my tax in Spain?

Every resident taxpayer's entitled to a tax free allowance in Spain which depends on your circumstance, such as age, martial status, date of arrival in Spain, or citizenship status.

Overall, there’re 3 main ways to reduce your taxes in Spain:

- Use your tax-free allowance

- Pay non-resident tax even as a resident (only for new expats)

- Benefit from the double taxation agreement between Spain and your home country

Personal tax free allowance

The personal tax free allowance depends on your age. Here’s how much you can earn in Spain before paying tax:

| Age | Tax-Free Personal Allowance | |

|---|---|---|

| Under 65 years | €5,550 | |

| 65-74 years | €6,700 | |

| Above 75 years | €8,100 |

Tax free allowance if you’re married

Married couples in Spain can file joint tax returns.

- First spouse will get an allowance of €5,550

- Second spouse will get an allowance of €3,400.

Sometimes its beneficial to file joint taxes and other times it might be better to file your taxes separately.

Tax free allowance if you’ve children

If you’re a parent in Spain and have children below 25 years of age living with you, you can receive tax free allowance for each child.

| Number of Children | Tax-free allowance | |

|---|---|---|

| 1 | €2,400 | |

| 2 | €2,700 | |

| 3 | €4,000 | |

| 4 | €4,500 |

If your child is younger than 3 years old and both parents are working, you can get an additional allowance of €2,800 per child.

Tax free allowance if you’ve dependent relatives

If you earn less than €8,000 per year and a family member above the age of 65 lives with you, you can claim tax allowances.

| Elderly age | Tax-free allowance | |

|---|---|---|

| Above 65 years | €1,500 | |

| Above 75 years | €2,550 |

Tax free allowance for disability

Disability allowance is calculate based on a grading system.

| Disability Grade | Tax-free allowance | |

|---|---|---|

| 33-65 years | €3,000 | |

| 65-100 years | €9,000 |

You can get an additional allowance of €3,000 if you’re hiring someone for the care, such as an at home nurse.

Pay non-resident tax even as a resident in Spain- Beckham Law

If you’re new to Spain, you can avoid paying a lot of tax by making use of the Beckham law.

By applying for the Beckham law, you’ll be considered a non-resident taxpayer even if you reside in Spain. So instead of paying progressive taxes on your worldwide income, you’ll pay 24% tax on your income generated in Spain for the first 6 years.

Other than saving you money, the Beckham Law also saves you time and effort as Spain’s tax system is often complicated since taxes differ per region.

Here’re the conditions you need to meet to make use of the Beckham Law:

- Must not have resided in Spain in the 10 years prior to living as a resident.

- You must be legally employed by a company that has a permanent establishment in Spain.

- The majority of your work needs to be done in Spain.

- You must apply for this within the first 6 months of your employment. You'll need to present your NIE number, passport and your contract of employment.

- Your income must not be more than €600,000

Dual tax arrangements with Spain

Since Spain taxes residents on their worldwide income, you might be wondering do I have to pay tax abroad and in Spain? Luckily Spain has dual tax arrangements with several countries, which means you don’t have to pay tax in your home country and in Spain for the same income source.

Please reach out to content@housinganywhere.com if you have any suggestions or inquiries about the content on this page.

Related articles

In this article

Find your home in Spain

Find accommodation in cities across Spain. Search for your accommodation now!

Search Now